Fair Lending Compliance Software

Unify your lending compliance journey from 1071 to CRA and HMDA under one user-friendly platform. Capitalize on real-time data, uncover growth opportunities, and supercharge team productivity with the assurance of expert guidance.

Fair lending compliance risk software trusted by thousands of financial institutions across the country

Revolutionary fair lending compliance software

Don't just stay compliant - stay ahead, with actionable data insights and expert guidance.

Actionable Visibility

Enjoy real-time visibility of lending data and stay exam-ready always with our fair lending software.

Growth Opportunities

Leverage Nrelief to analyze lending trends and discover growth opportunities effortlessly.

Click-Away

Expert Support

Benefit from top-tier customer service, with industry experts just a click away on your journey to success.

Amplified Productivity

Liberate teams from manual tasks, reduce errors, and supercharge productivity with our fair lending risk assessment software.

Uncovering Fair Lending Risk to Build a Stronger Fair Lending Program

This whitepaper will provide tools for:

- Helping financial institutions uncover and analyze their fair lending compliance risk

- Implementing appropriate controls

- Enhancing your overall fair lending program at a time of increased government and public scrutiny

%20(1).png?width=1000&height=809&name=Copy%20of%20Various%20Clients%20%20Social%20Images%20(6)%20(1).png)

Powerful fair lending compliance risk software

With Nrelief, you gain access to premium features and tools like:

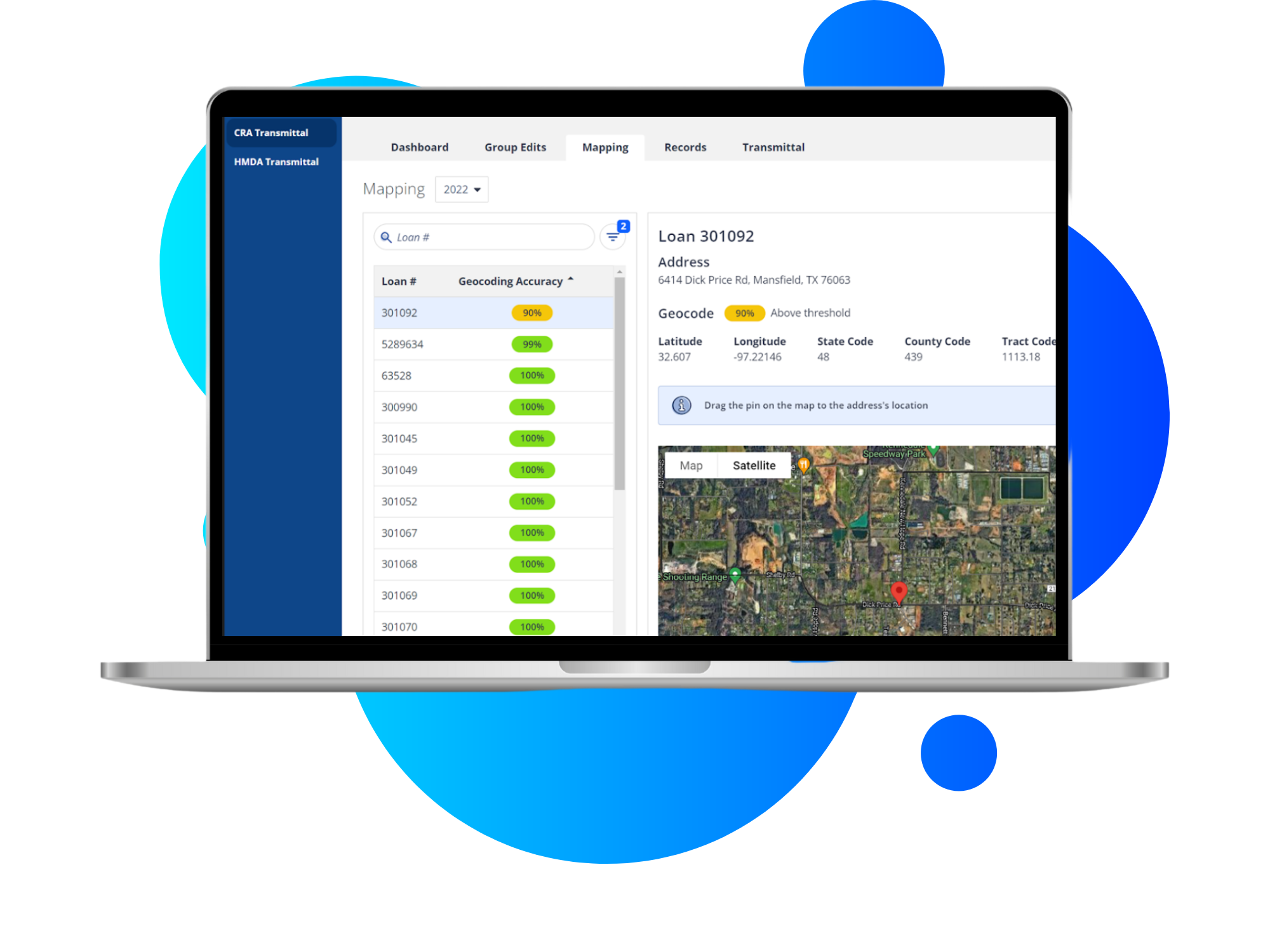

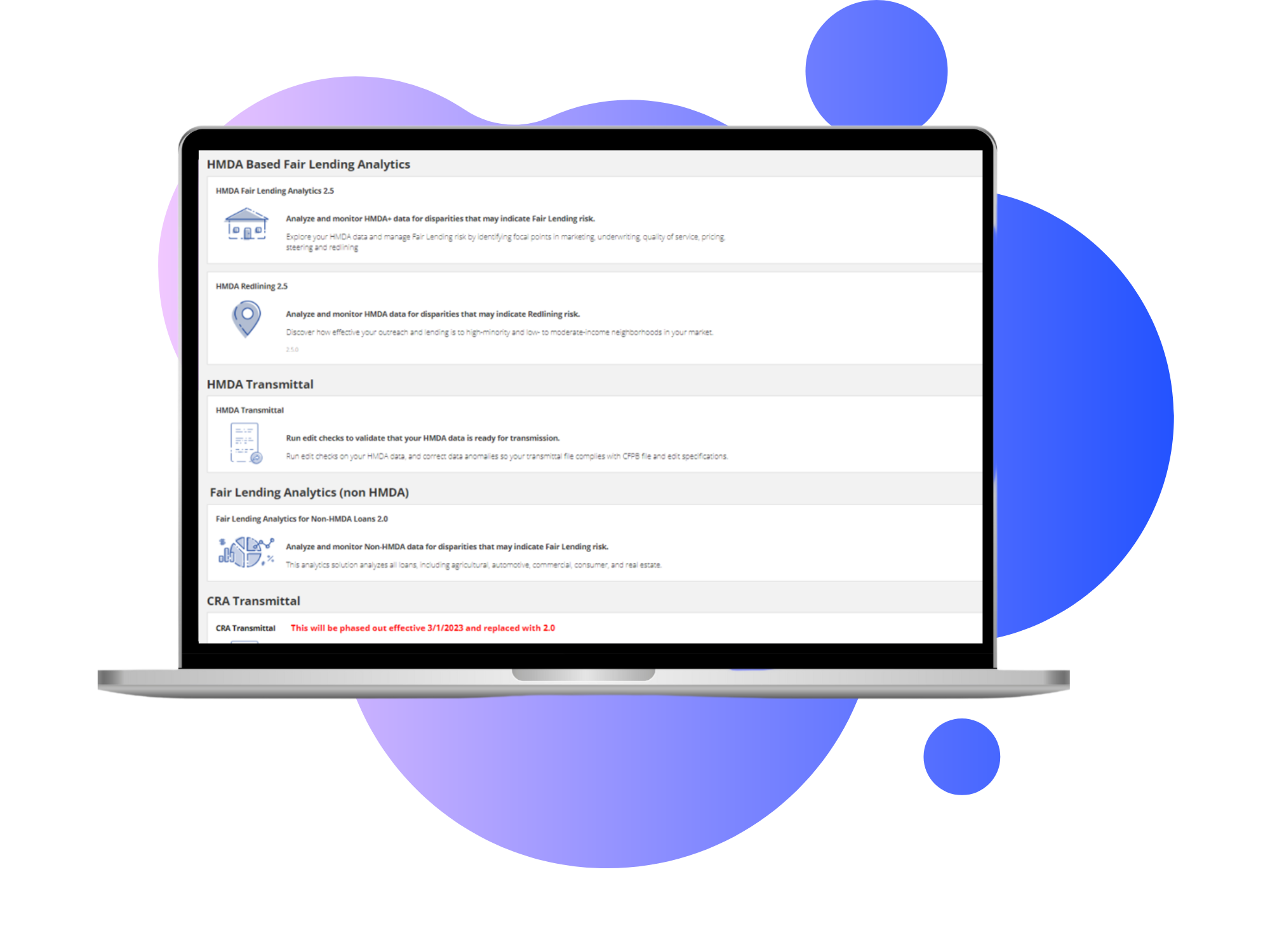

Effortless Compliance with Automation

Embrace an era where HMDA and CRA transmittals are no longer a burden. Intelligent automation of our fair lending risk software streamlines your data preparation, conducts rigorous quality reviews (including meticulous edit checks and data cleanups), and efficiently submits the data to the relevant regulator.

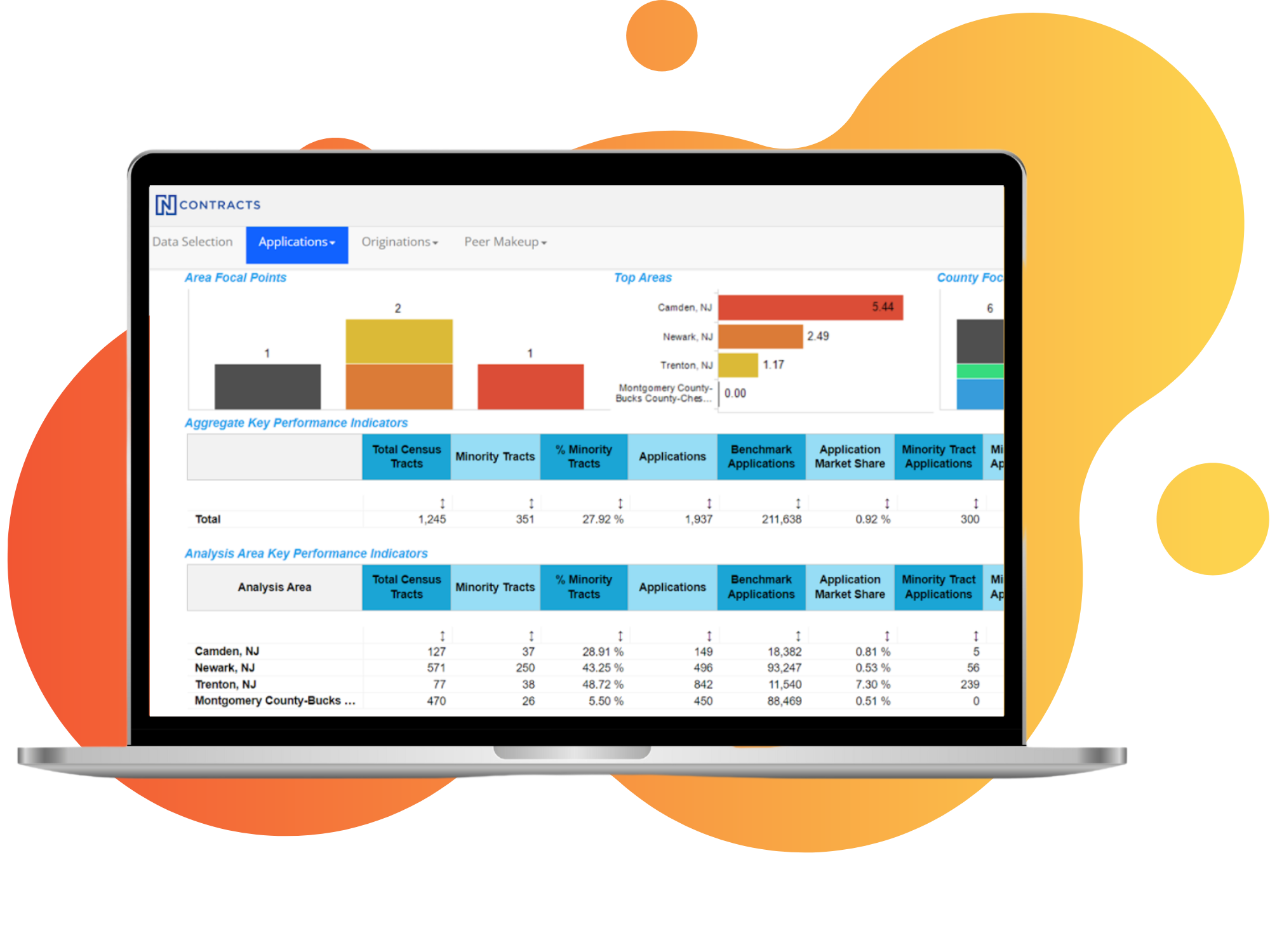

Proactive Lending Analytics

Leverage the power of data to shape your lending strategy. Our sophisticated data analysis tools illuminate trends in your lending patterns. You can proactively address potential fair lending issues, and more importantly, seize profitable opportunities within your target market. Turn raw data into actionable insights that drive growth using our fair lending risk assessment software.

Exclusive Access to Expert Analysts

Deepen your understanding of your loan portfolio with guidance from Ncontracts' seasoned fair lending analysts. Our expertise grants you nuanced perspectives, transforming complex data into compelling narratives that make sense of your loan portfolio. You're not just buying a product; you're securing a partnership with industry veterans.

Fair Lending 2024: Top 7 Takeaways

What do you need to know about fair lending compliance in 2024? That’s the question we answered in our webinar.

The Fair Lending Analytics Buyer’s Guide

Learn about the key components to look for in a modern fair lending analytics solution.

7 Essential Fair Lending Risks

Fair Lending compliance can be complex - but a clear understanding of your risk can make it much simpler.